Richard Butler | Exclusive Report by ORGANIC TRADE ASSOCIATION | 14TH MAY, 2024

Organic Trade Association pegs sales of organic products near $70 billion

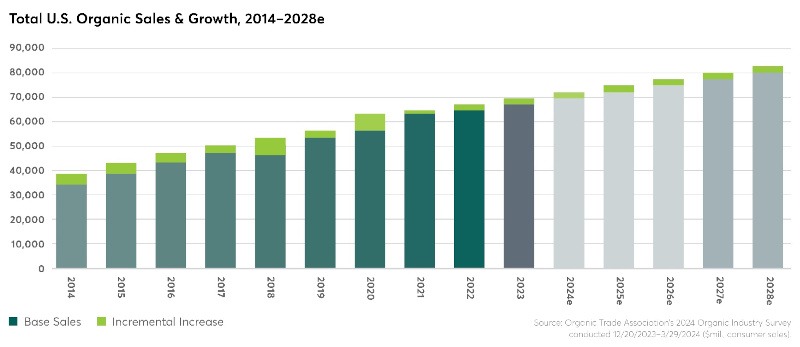

U.S. sales of certified organic products approached $70 billion in 2023, a new record for the sector. Dollar sales for the American organic marketplace hit $69.7 billion last year, up 3.4 percent, according to the 2024 Organic Industry Survey released Tuesday by the Organic Trade Association (OTA).

Despite stubborn price inflation seen throughout retail aisles, consumers remained clear-eyed about their priorities in the products they chose for themselves and their families, valuing health and sustainability, and seeking out the USDA Organic label. The organic marketplace recalibrated its supply chain and reconciled the cost of doing business in part with increased retail pricing. The industry continued to grow, with organic food sales in 2023 totaling $63.8 billion and sales of organic non-food products totaling $5.9 billion.

“It is encouraging to see that organic is growing at basically the same rate as the total market. In the face of inflation and considering organic is already seen as a premium category, the current growth shows that consumers continue to choose organic amidst economic challenges and price increases. Although organic is now a maturing sector in the marketplace, we still have plenty of room to grow,” says Tom Chapman, co-CEO of OTA.

Matthew Dillon, co-CEO of OTA, adds that to achieve this growth, “It is essential to educate consumers that choosing organic is a straightforward way to tackle some of the greatest challenges we face. Whether it’s accessing healthy foods, improving transparency in supply chains, mitigating climate change, supporting rural economic resilience, protecting natural resources, or realizing the multitude of other benefits, effectively communicating and delivering on these promises is the key to expanding organic’s share of our dinner plate.”

In 2023, the increase in dollar sales in the organic market was driven more by pricing than unit sales. But that said, consumers boosted their purchases of many organic products. Increases in unit sales were reported for up to 40 percent of the products tracked in this year’s survey. The survey also showed that prices for many non-organic products climbed at a faster rate than organic products. This means the price gap between conventional and organic is closing, which should help fuel growth for organic products in 2024.

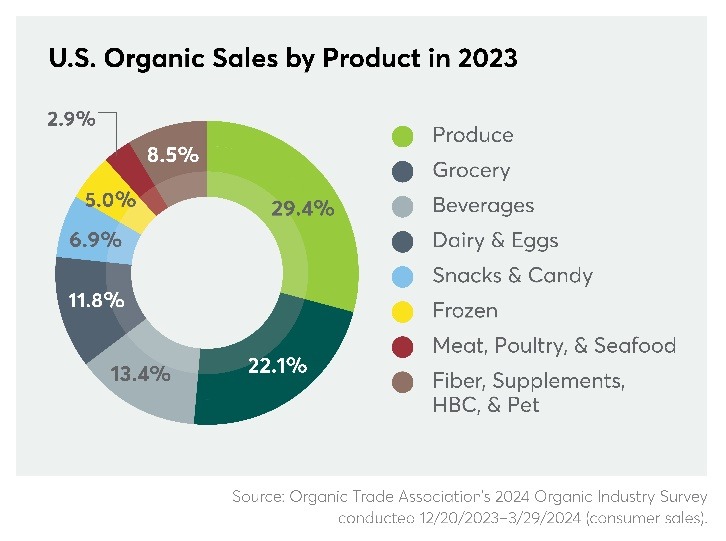

Produce held its spot as the largest organic category in 2023, continuing to be the primary entry point for consumers into the organic market. Organic produce meets the consumer’s desire for clean, healthy food, and the importance of organic’s critical benefit of no toxic synthetic pesticides is easy to grasp when buying organic berries or carrots. In 2023, the category grew by 2.6 percent to $20.5 billion. Organic produce now accounts for more than 15 percent of total U.S. fruit and vegetable sales. Top sellers in the organic produce section were avocadoes, berries, apples, carrots, and packaged salads, and organic bananas saw stronger growth in 2023 than non-organic bananas.

The second biggest-selling food category in the organic aisles was the grocery category with sales of $15.4 billion for a 4.1 percent growth. This new category represents many of the products previously grouped under breads and grains, condiments, and packaged and prepared foods. With 21 different subcategories, close to 40 percent of the sales in the grocery category were driven by the top three performers —in-store bakery and fresh breads with sales of $3.1 billion for a gain of almost 3 percent, dry breakfast goods up around 8 percent to $1.8 billion in sales, and baby food and formula at $1.5 billion for a hefty gain of nearly 11 percent.

Beverages were the third largest category for organic in 2023, posting $9.4 billion in sales, up 3.9 percent. As always, this category was a driver of innovation with functional beverages, whether for enhanced hydration or mental focus, playing a prominent role. 2023 also saw a surge in new organic non-alcoholic beverages and mocktails. On the flipside, organic wine sales were up 2.5 percent to $377 million, and organic liquor and cocktails, while still the smallest sector of beverages at $59 million, posted over 13 percent growth.

Organic dairy and eggs, the fourth-largest category in the organic food market is another entry point for consumers who want clean, ethical sources of protein with lower environmental impacts. In 2023, organic dairy and egg sales were up 5.5 percent, reaching $8.2 billion. Organic dairy and eggs now account for over 8 percent of all dairy and egg sales. Milk and cream sales were up almost 5 percent to $4.2 billion, and the organic dairy alternative category grew almost 14 percent in 2023 to around $700 million.

The rate of growth in the sales of the organic non-food categories was mixed. Personal care products saw the strongest growth in 2023 with sales reaching $1.3 billion up almost 7 percent, and sales of organic supplements were up over 4 percent to $2.1 billion. Organic fiber continues to be the largest segment of the U.S. organic non-food products, representing 40 percent of the category’s sales in 2023 of around $2.4 billion. Sales for organic fiber were essentially flat year-over-year, not due to lack of buyer interest but restricted more by supply chain issues.

Organic remains a stand-out in a growing sea of labels

The number of claims and labels continued to expand in the retail aisles in 2023, but the organic seal stayed a stand-out with consumers. A growing consumer focus on personal and family health, sustainability, and a desire for clean products free from antibiotics, hormones, preservatives, and dyes kept shoppers turning to organic. More consumers are aware of the potential health benefits associated with organic foods, and many consumers, especially the Gen Z generation, are increasingly conscious of the ethical implications of their food choices and are looking for products that align with their values, such as animal welfare, fair trade, and support for organic farmers.

Research is showing a consistent and growing interest in organic from Millennials and Gen Z. These generations grew up with organic and sustainability, and the health of people and planet, are all top-of-mind for these consumers. Industry experts see this as an opportunity for organic, with the sector well positioned to meet the product attributes and values sought by consumers today and for future generations. By 2030, the U.S. population will consist of a majority driven by Millennial, Gen Z and younger generations.

But the future for organic is not without its challenges. The latest term adding confusion to the marketplace is “regenerative.” While regenerative labels are not necessarily top of mind for consumers yet, the attributes they claim to represent include soil health, animal and human welfare, and biodiversity — attributes already embodied by the USDA Organic seal. As new certifications develop around regenerative agriculture, there is concern of consumer confusion, making it all the more important to elevate organic education.

Methodology

This year’s survey was conducted early in 2024 and was produced on behalf of the Organic Trade Association by Nutrition Business Journal (NBJ). Numerous data sources were compiled to create as complete a picture as possible of the organic industry which consists largely of private companies. Inputs include but are not limited to point-of-sale data, expert interviews, annual report data, and in-depth direct survey data. Roughly 65 companies completed a significant portion of the in-depth survey.

In an effort to better represent how products are marketed within the grocery aisles, newly arranged organic product categories are being presented in the 2024 report. Shelf stable and fresh products that have traditionally been part of the packaged and prepared foods, breads and grains, and condiments category are now largely part of the new grocery category. Fresh produce, the largest organic subcategory, is now a full-fledged category of its own, as frozen and canned produce is now in the grocery category.

About the Organic Trade Association

The Organic Trade Association (OTA) is the membership-based business association for organic agriculture and products in North America. OTA is the leading voice for the organic trade in the United States, representing more than 500 organic businesses across 50 states and 9,500 farmers through its Farmers Advisory Council. Its members include growers, shippers, processors, certifiers, farmers’ associations, distributors, importers, exporters, consultants, retailers and others. OTA’s Board of Directors is democratically elected by its members. OTA’s mission is to promote and protect ORGANIC with a unifying voice that serves and engages its diverse members from farm to marketplace.