Richard Butler | Exclusive Report by PACIFIC TRADE INVEST | 2ND AUGUST 2024

EXPORT REVENUE RETURNS TO PRE-PANDEMIC LEVELS

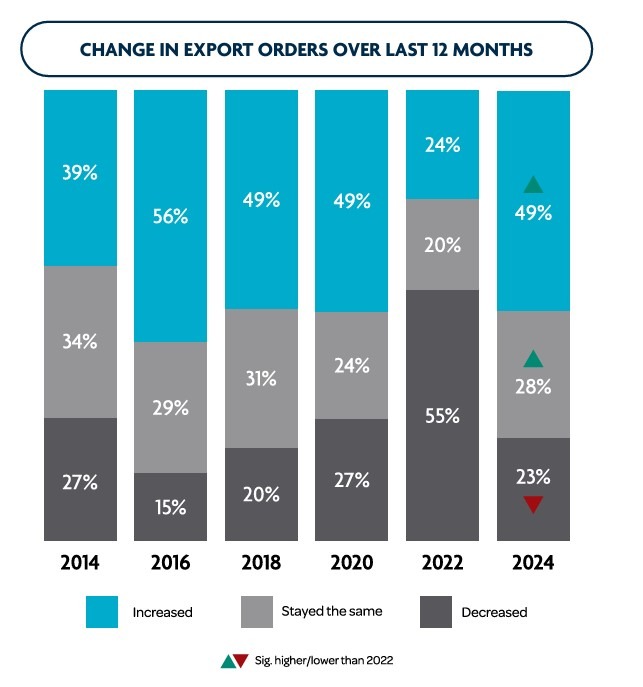

Over the past 12 months, Pacific businesses have seen export revenue return to pre-pandemic levels. Whereas only 24 per cent reported revenue increases in 2022, this has more than doubled to 49 per cent in 2024. As such, businesses are extremely optimistic about the next 12 months, with 78 per cent expecting an increase in export revenue over the coming year, marking the highest confidence level among respondents since tracking began.

As in previous years, businesses are bolstering their growth by prioritising process improvements and efficiencies. Additionally, this year has seen a notable increase in those encouraging innovation through staff training and hiring, with 40 per cent of businesses citing this as an initiative compared to 23 per cent in 2022.

In conjunction with these organisational improvements, one third of businesses have contacted Pacific Trade Invest for assistance, a rate that has been steadily increasing over the past four years.

ACADEMIC FOREWORD

The Pacific Export Survey 2024 provides key insights into the economic ecosystem of our region. This data supports the work to meet Sustainable Development Goals eight (decent work and economic growth) and nine (industry, innovation, and infrastructure). It also underpins the implementation of the 2050 Strategy for the Blue Pacific Continent, especially Pillar Four: ‘Resource and Economic Development’.

This data tells a story of ongoing recovery from the impacts of COVID-19, with mixed results. Overall, export revenue has increased markedly, by 49 per cent, bringing it back to pre-pandemic levels. Exports to Europe and North America have increased since 2022 and have returned to pre-COVID levels. However, whilst exports to China have increased since 2022 (from 9 per cent to 12 per cent), they are still well down on the 2020 figures for that market (18 per cent). This recovery feeds high levels of confidence, with 78 per cent of respondents expecting an increase in export revenue over the coming year. This has flow-on effects: the data shows an increase in expectation of hiring new staff in the next year. In addition, 71 per cent of businesses plan to expand into new export markets within the next three years.

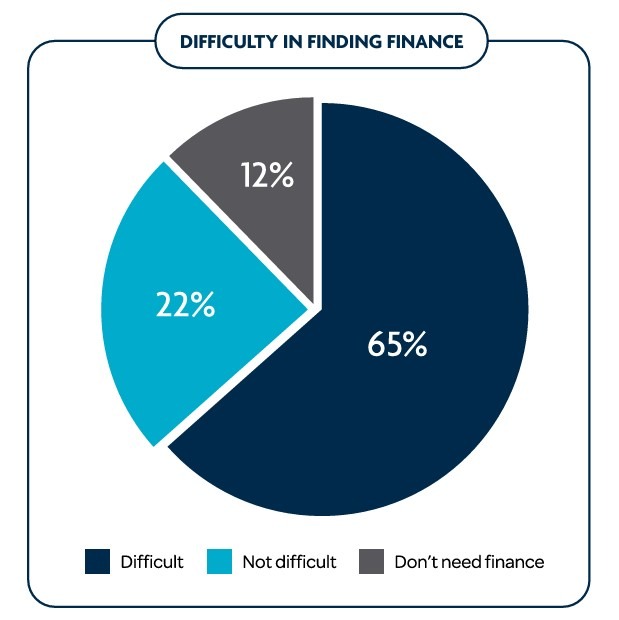

When it comes to supporting Pacific exporters, there is more work to do. Some challenges are persistent, presenting barriers to exporting. Access to finance remains in the top five barriers, despite an improving trend since 2018. Challenges associated with labour issues has increased slightly from 26 per cent to 29 per cent. Given what we are learning elsewhere about the impacts of labour mobility programmes in sending countries, this will likely be more significant in the future.

Across the world business practices are changing. Pacific Trade and Invest (PTI) has supported an increased uptake of online and digital tools among Pacific exporters. Digital activity is increasing, especially in the tourism and services sectors. The most predominant aspect of this is the use of social media with the use of third-party websites/ apps remaining very low in the mix. Overall, the full maximisation of digital capacity is still a work in progress. The appetite for training among Pacific exporters remains strong, including in relation to increasing revenue using online channels.

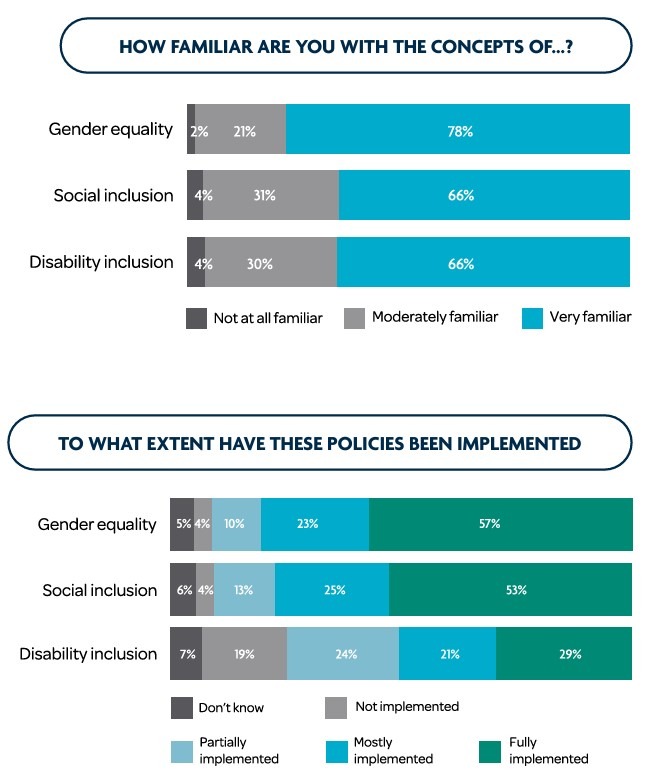

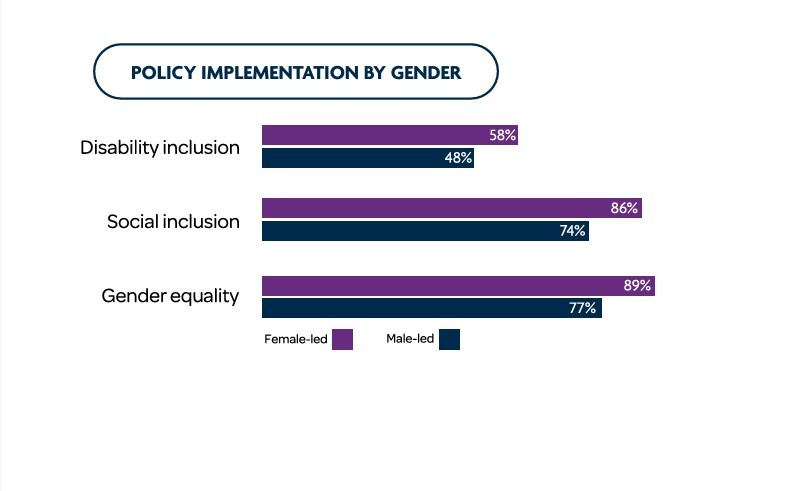

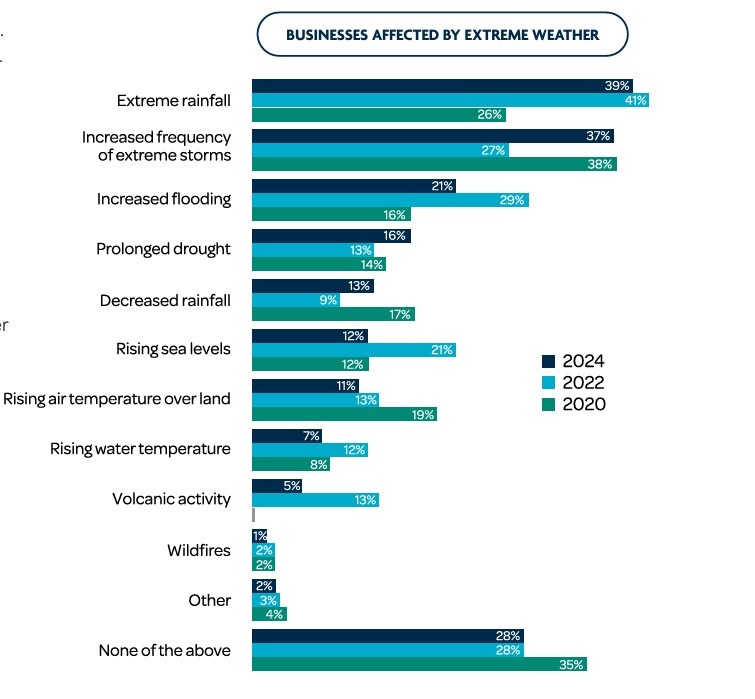

It is not surprising to learn that the climate crisis has significant impacts. This data reveals that 72 per cent of respondents were affected by severe weather patterns in the preceding 12 months, with the impact of extreme storms showing an increase of 10 per cent over the 2022 f igures, from 27 to 37 per cent. The agriculture and tourism sectors are particularly vulnerable to these impacts. New to this year’s survey is data relating to gender equity, disability and social inclusion (GEDSI). Awareness of the importance of gender equity is well-established among Pacific exporters. Businesses led by women, or which employ a person living with a disability demonstrate a greater awareness of GEDSI principles. This report is an important tool not only for PTI but for all those who work in the business ecosystems of the Pacific Islands region.

GENDER EQUALITY, SOCIAL AND DISABILITY INCLUSION (GEDSI)

Pacific businesses, in particular female-led operations, demonstrate a high degree of understanding and practical application when it comes to gender equality, social and disability inclusion (GEDSI) concepts. More than 96 per cent of respondents have a level of familiarity with these concepts, with gender equality currently the most familiar. Of survey respondents, approximately 80 per cent have either mostly or fully implemented GEDSI policies and practices throughout their businesses, with less than approximately 10 per cent indicating they had not implemented any or were unsure.

Despite the implementation of GEDSI policies and practices being uniform across all industry sectors, female-led businesses excelled in this arena, as well as leading workplace accessibility to information, services and spaces for individuals with disabilities.

LOCAL AND INTERNATIONAL MARKETS

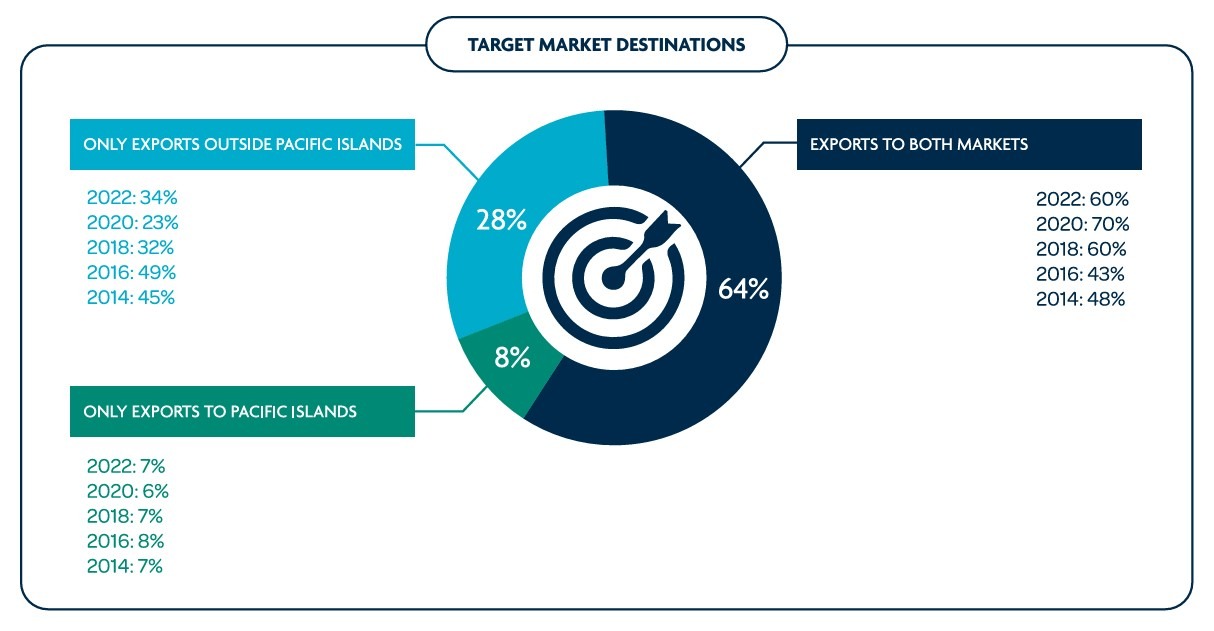

Pacific exporters are increasingly selling to both international and local markets throughout the Pacific, with more than 64 per cent citing this dualmarket approach compared to 48 per cent when the survey begun in 2014.

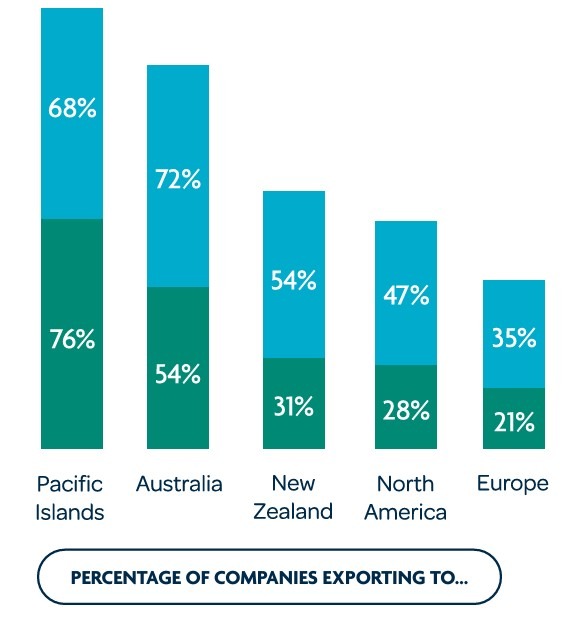

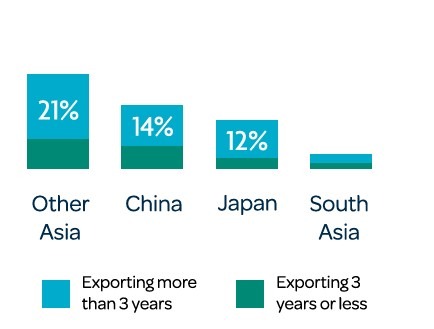

Internationally, Australia and New Zealand continue to be key export destinations, with North American and European exports back to pre-pandemic levels. Despite this, businesses are increasingly targeting their export efforts, with new market expansion on a slow downward trend at 71 per cent compared to 86 per cent in 2016.

While confidence is showcased by exporters expecting to increase revenue from existing export destinations, the decline of new market expansion could also be attributed to export barriers such as logistics costs.

DIGITAL MARKETING

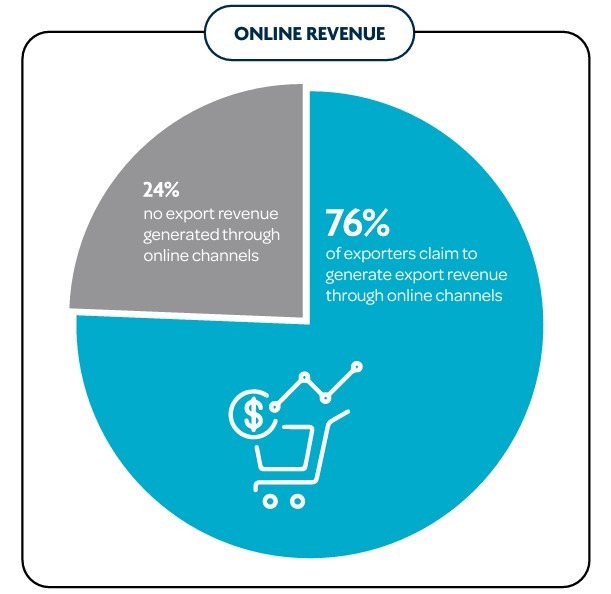

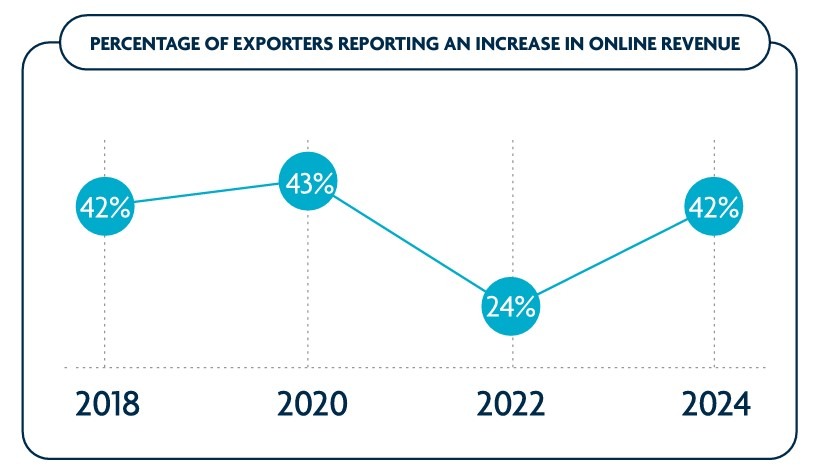

Digital marketing continues to be a significant strategy for Pacific exporters, with 76 per cent generating revenue online. This online revenue has returned to pre-pandemic levels, with 42 per cent reporting increased revenue compared to 24 per cent in 2022.

Whereas in 2022, increased use of online channels was cited as the largest positive impact to online revenue, this year’s respondents have cited easier access to digital devices as the main driver at 54 per cent.

For exporters not generating revenue online, the proportion specifically citing that online channels are not relevant to their business has dropped to 11 per cent from 57 per cent in 2022, pointing to increased understanding of the diverse ways online presence can bolster business.

CLIMATE IMPACTS

Climate impacts and extreme weather events continue to pose significant challenges for Pacific exporters, with 72 per cent of businesses being affected in the last 12 months. Major impacts have risen significantly to 47 per cent compared to 34 per cent in 2022, while minor and minimal impacts have decreased.

Of those affected, 82 per cent have experienced disrupted operations, predominately when it came to productivity, while 66 per cent reported damage to products, crops, catch or property, and 43 per cent cited increased operation costs as a result of extreme weather patterns.

This impact has been felt significantly across the Tourism industry, with weather events contributing to business closures, customer decline and increased insurance premiums.

FINANCE AND INVESTMENT

Access to finance and investment still represents a significant barrier for Pacific exporters, with 65 per cent stating it is difficult to obtain finance, making this the highest level since reporting begun in 2014.

Despite obtaining finance being cited as difficult by a majority of exporters across all industries, the Agriculture sector has felt this barrier the most, at 76 per cent.

The reason finance is difficult to obtain is still largely attributed to businesses having limited financial track records. However, political issues and lack of bank flexibility have both become significant contributors, with 34 per cent citing the latter compared to 23 per cent in 2022.

LOGISTICS AND LABOUR ISSUES

While export costs and logistics challenges still represent the main barriers for Pacific exporters, the results have returned to prepandemic levels, at 46 per cent and 40 per cent respectively. Overwhelmingly, these challenges have impacted the Agriculture and Manufacturing sectors more than other industries.

Exporters requiring shipping route support has increased from 35 per cent in 2022 to 45 per cent in 2024, with those who want assistance for inter-Pacific trade routes tripling since 2022 to 14 per cent.

The barrier of labour issues has risen this year to 29 per cent, overwhelmingly affecting the Tourism sector with 42 per cent of operators citing this barrier compared to 26 per cent in 2022. Mature exporters have also been disproportionately affected compared to new exporters.